Fundamentals First

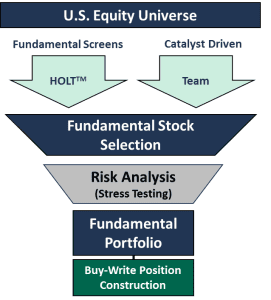

The investment process is fundamentally driven with an investment universe consisting of the S&P 500 that meet the Van Hulzen screening criteria plus similar equities that meet the same minimums, which focuses on the highest quality names in the US. This includes companies with sustainable business models, strong, consistent ROIs, strong dividend profiles and below average debt. It intentionally excludes companies with speculative businesses, inconsistent results and above average debt. The Credit Suisse HOLT ™ framework is a key component in the fundamental process. Credit Suisse HOLT ™ is an objective, empirically-driven framework with performance metrics that have the highest correlation with stock price. The team does considerable stress testing on holdings, including downside scenarios and technical analysis.

Equally important to the approach is the commitment to never buy a stock purely because its options are attractive, as this can inadvertently result in a riskier underlying portfolio. A covered call portfolio, as suggested by the growing body of evidence, may be a low volatility alternative allocation within an equity portfolio. As such, a covered call portfolio should be a consistent, reliable group of companies with covered call overlaid. The process seeks to match the merits of a covered call allocation to the construction of a portfolio that can achieve that purpose.

Dividend Focus

Many dividend strategies focus on companies with the highest dividend yields and inherently end up overweight utilities, telecoms and tobacco companies as these are the businesses that pay the highest yields. Although the dividend yield of the portfolio is higher than the index, the strategy do not necessarily target companies with the highest dividend yields. Instead, it is preffered to own companies that have demonstrated higher than average dividend growth and a lower than average total payout ratio (meaning they have plenty of capacity to continue to grow their dividends). For example, a typical holding might have a current dividend yield of 2.5%, with 15-20% dividend growth (versus 7-8% for the S&P) and a total payout ratio of only 30% (versus 90-100%+ for many of the top yielding names). (for illustrative purposes only)

The investment process results in a potentially distinctive equity portfolio profile, with possible:

- Higher than average ROI

- Higher than average fundamental price upside

- Higher than average dividend yield & dividend growth

- Lower than average debt

- Lower than average beta

Call Options

Once the portfolio holdings are defined, individual call options are sold with the objective of achieving our fundamental targets for total return, but with a higher income component and lower risk than long-only. The option overlay strategy is optimized for each equity position and dynamically managed in order to maximize call premium income while minimizing exercise risk. This way the strategy collects the dividends on the positions and benefit from a larger portion of the potential price appreciation. In normal market conditions, 80-100% of holdings are covered. Historically, the portfolio has a total investment yield of 6-8%, with 3-6% coming from the option premiums (depending on market conditions).

Portfolio Construction & Risk Management

Risk management is central to portfolio construction. Holdings are weighted based on each company’s risk-return ratio (fundamental upside potential divided by downside risk) and sector weights are similar to index weightings. Holdings with the highest ratios receive the largest weightings in the portfolio.

Before entering a position, a downside target is determined. Any holding whose price falls below that downside price will be triggered for a potential sale.

The underlying philosophy is that a covered call strategy must be a consistent strategy. To use a baseball analogy, the use of covered calls eliminates the prospect of a home run. Because of this, strong risk controls need to be in place to minimize “strikeouts.” The process is designed to reach base safely as often as possible: walks, singles and doubles.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment plan or strategy will be successful. The small cap strategy is not suitable for all investors. Speak with a qualified advisor before investing.